Join us at AGG1, St Louis, MO - America's Center Convention Complex: 25-27 March

To celebrate a decade of innovation since CheckProof’s inception in 2014, this report highlights significant milestones across the construction materials industry over the last ten years. From 2014’s economic optimism boosting infrastructure demand, to more widespread adoption of AI and machine learning in 2024. Each year showcases industry advancements that pushed the boundaries in innovation, digitalization, and sustainability.

It’s been an era of transformation for both the industry and CheckProof. If you operate in the construction materials and heavy industry, this report captures key moments that you need to be aware of.

2014: Consumer confidence strengthens the Construction Materials industry

Recovery from the 2008 financial crisis continues. Consumer confidence strengthens with the US Consumer Confidence Index (CCI) reaching 78.1 in December. This is close to levels seen before the US government shutdown and the highest since 2008, reflecting optimism in the economy and job outlook. The National Association of House Builders (NAHB) Housing Market Index (HMI) in the US reached 58 in December, indicating strong builder confidence thanks to rising home sales and fewer vacancies, matching the highest levels seen since 2005. The optimism drives demand in infrastructure and construction as economies globally regain momentum.

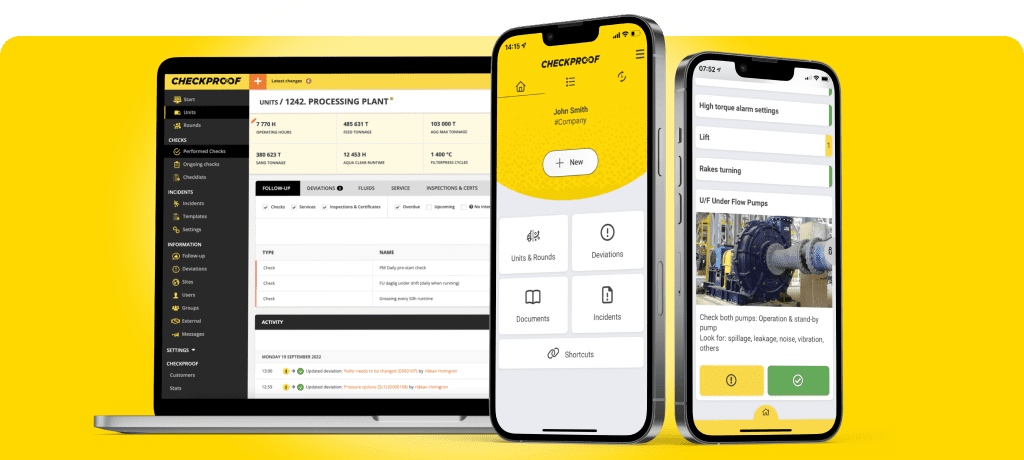

In Stockholm, Sweden, childhood friends, Håkan and Jonas, founded CheckProof, a digital platform coupled with a frontline-friendly app, revolutionizing maintenance, and HSEQ management.

2015: Paris Agreement signed

The Paris Agreement heralded an era of global commitment within the construction materials and heavy industries to reduce emissions and adopt sustainability measures. Regarding digital adoption, in 2015, companies were found to be at varied stages of digital transformation. Heavy-side producers, like those in aggregates, concrete, and construction, were at the earliest stage.

However, some tools did take off, for example, Building Information Modelling (BIM) became a powerful tool in driving efficiency and increased productivity in the construction industry. Material innovations such as nanocomposites began transforming the cement industry.

However, even the most digitally advanced construction materials companies still lagged behind sectors like media, retail, and travel in their digital maturity.

Sensing the time was right for a mobile maintenance management system, CheckProof officially launched its app.

2016: Skilled labor shortages continued to impact companies.

Skilled labor shortages continued to impact companies, driven by workers leaving during the recession and never returning, resulting in staffing challenges. Offsite construction methods, like prefabrication, gained traction as a cost- and time-saving solution. Due to labor constraints, companies also became more selective in taking on projects. Green building saw continued growth in both commercial and residential sectors.

Additionally, with a focus on heightened regulatory scrutiny and fines from safety organizations like OSHA in the US for job-site-related accidents, companies begin to reevaluate their safety procedures. Health, Safety & Environment inspections, as well as Quality Control routines, start taking priority.

CheckProof’s app gains traction as it addresses consistency in maintenance and health and safety routines. The company expands its client base outside of Sweden, signing clients in the UK, Estonia, and Norway.

2017: Internet of Things (IoT) becomes a buzzword

The construction materials industry strives for more widespread use of IoT-powered solutions. Advances in IoT and 24/7 connectivity drive the adoption of Building Information Modeling (BIM) across the construction value chain, enabling firms to streamline operations, reduce costs, and engage more directly with end customers. In the concrete, minerals, clays, and stone segment, earnings rose above the cost of capital, signaling profitable growth.

The need to build adaptable and resilient supply chains becomes pertinent after the devastating hurricanes Harvey, Irma, and Maria in the US.

Global demand for concrete reached new highs with urban growth, especially in China and India.

CheckProof gains its first client in China with FLSmidth.

2018: Sustainability & technology in focus

Sustainability and technology remained central to innovation in the building materials industry, alongside continued growth and optimism fueled by economic expansion. Demand surged for green building materials that reduce carbon footprints, resist moisture, and promote durability—preferences driven by consumer interest in environmental impact, material safety, and energy efficiency. Innovations included hydro ceramic bricks, light generating concrete that absorbs sunlight and radiates it after dark, self-healing concrete, and smart home systems, marking a shift toward advanced, eco-friendly construction options. New construction technologies like 3D printing and drones also rose in prominence, with drones increasingly supporting aerial inspection and automating specific construction tasks.

At CheckProof, monthly controls reach an all-time high with 17,000 completed checks per month.

2019: Consolidation of industry manufacturers continues

Increased demand for high-strength, high-durability concrete as megacities expanded globally. The aggregate industry showed solid growth, with crushed stone, sand, and gravel production remaining strong. Growth of carbon capture and storage (CCS) technologies in cement plants to address emissions targets. Rising emphasis on climate resilience in infrastructure projects, especially in flood-prone and earthquake-prone regions, spurring demand for stronger, more resilient building materials. The possibility of an infrastructure bill was floated in US Congress was floated, but never came to pass.

Consolidation of industry manufacturers continued. Overall, this year was marked by stable demand and healthy output levels, reflecting a more normalized economic pace.

CheckProof exhibits at Bauma, marking its commitment to serving the construction materials industry on a global stage.

2020: The pandemic leaves a heavy footprint

The COVID-19 pandemic led to reduced demand due to construction halts but sparked interest in contactless construction technology and digital monitoring. Increased reliance on digital platforms for remote site monitoring, project management, and safety compliance in construction. Supply chain disruptions forced industries to re-evaluate local production and material sourcing strategies, impacting cement and aggregate suppliers. Nevertheless, several aggregate producers expressed cautious optimism, ending the year relieved by steady operations despite the challenges of COVID-19 seeing growth opportunities through adaptability and internal improvements.

CheckProof sees increased adoption as digital maintenance tools become increasingly important with less reliance on key staff.

2021: US infrastructure bill passed

The US infrastructure bill was passed authorizing $1.2 trillion for transportation and infrastructure spending. Coupled with post-pandemic stimulus packages worldwide, it contributed to recovery in the construction industry.

However, the industry still struggled with ongoing challenges in the supply chain and shortages in filling key staff vacancies. Equipment lead times were extraordinarily lengthy.

Heightened urgency around climate change led to stricter emissions regulations and penalties in the EU, impacting cement and asphalt production methods.

Prices of construction materials increased by almost 20% in 2021.

CheckProof reaches thousands of active users, signaling rapid adoption.

2022: Higher energy prices lead to further development of electric machinery

The building materials industry faced significant cost pressures in 2022. Inflation drove up input, and higher energy costs, particularly in Europe (due to the Russia-Ukraine conflict) were also compounded by carbon taxes. While demand for home repairs and infrastructure remained strong, higher input costs threatened profit margins. Pricing strategies became crucial to offset the expenses, especially for energy-intensive sectors like cement.

A desire to shift towards more electric solutions led to major developments of electric and hybrid machinery for quarrying and asphalt mixing, reducing carbon emissions on construction sites. Companies pledged to achieve net-zero emissions, pushing the industry toward renewable energy in production processes.

CheckProof rolls out sustainability-focused features, such as fleet optimization, to end excessive idling.

2023: Global focus on resilient infrastructure

The aggregate industry in 2023 maintained strong demand, with notable trends in digitalization, electrification, and sustainability. While workforce challenges persisted, leaders addressed ways to attract a broader talent pool. Continued adaptability and technological adoption remain central as producers aim to meet evolving industry demands and navigate potential future challenges. Global focus on resilient infrastructure after extreme weather events underlined the need for high-strength, climate-resistant building materials.

Increased adoption of predictive maintenance IoT technology for machinery was used in aggregate, cement, ready-mix concrete, and asphalt production, enhancing equipment life and operational efficiency.

CheckProof was named a finalist in Sweden’s TechArenan Challenge.

2024: AI & machine learning are increasingly implemented

The construction materials industry is harnessing AI and machine learning for quality control, particularly in ready-mix concrete, where on-site adjustments optimize mix quality and reduce waste. Predictive maintenance through advanced sensors is used increasingly to prolong the life of key equipment and secure routines for health and safety and environment control inspections.

As circular materials gain traction, legislative mandates support sustainable building and recycling efforts across major markets. Additionally, emissions-reduction incentives are pushing heavy industries toward renewable and low-carbon production methods, enhancing resilience amid ongoing climate challenges.

CheckProof secures investment from Viking Venture, a leading Nordic Venture Capitalist firm, thus paving the way for further geographic expansion into new markets.

This trend report underscores the shift toward digitalization, sustainability, and innovation within the construction materials industry, with ongoing world events and regulatory shifts driving this evolution. These insights offer a perspective on the significant strides the industry has made, displaying resilience whilst navigating difficult world events.

We look forward to moving into 2025 with an even stronger digitization, efficiency, and sustainability focus.

Sources:

Duff & Phelps: Building Products and Materials Industry Insights

Want to know what CheckProof can do for you?

CheckProof's easy-to-use app makes it easier to do the right thing at the right time. Discover how you can run world-class maintenance that is both cost-effective and sustainable.

Maximize Efficiency with an OEE Monitoring System

Plant Asset Management Software:Maximizing Equipment Uptime

Machine Downtime Tracking: The key to smarter, more efficient operations

CMMS Software: What it is and why it’s key to First-Class Maintenance Operations

Revolutionizing Compliance: Banner Contracts on managing ISO audits with CheckProof

Implementation of Digital Systems: Rolling Out CheckProof Across Teams

From Fuel Savings to Production Gains: Cemex Germany’s Wins with CheckProof

A Recap of the CheckProof Industry Event & 10th Anniversary Celebration

Trend Report: Key moments in the Construction Materials industry (2014–2024)